- A Remerge guide to retargeting for gaming apps

- Mobile gaming categories

- 3 benefits of retargeting mobile gamers

- Remerge’s best practices for retargeting mobile gamers

- Why Remerge’s gaming clients run app retargeting campaigns

- KPIs Remerge gaming clients favor

- Where to spend retargeting budgets for mobile games

- Remerge’s DSP for retargeting campaigns instead of Google and Meta

- Get started with Remerge

Why gaming studios spend big on in-app retargeting

- A Remerge guide to retargeting for gaming apps

- Mobile gaming categories

- 3 benefits of retargeting mobile gamers

- Remerge’s best practices for retargeting mobile gamers

- Why Remerge’s gaming clients run app retargeting campaigns

- KPIs Remerge gaming clients favor

- Where to spend retargeting budgets for mobile games

- Remerge’s DSP for retargeting campaigns instead of Google and Meta

- Get started with Remerge

April 24, 2025

Every minute, users spend over $156,000 inside mobile games across Android and iOS. And, with the number of global gamers expected to surpass 2 billion within five years, the opportunity for gaming studios to increase revenues from their titles has never been bigger — or more competitive.

Faster smartphones, 5G connections, and easy, one-tap payments through Apple Pay, Google Wallet, and PayPal have made it simpler than ever for players to download, play, and pay.

But here’s the challenge: half of all gaming apps are uninstalled within 30 days.

A Remerge guide to retargeting for gaming apps

Winning a download is only the beginning. If gaming app marketers want players to stick around, and spend, they need smarter strategies to re-engage them, at scale. Programmatic in-app retargeting helps them connect with their players using personalized ads that boost engagement, drive more purchases, and cut churn rates.

At Remerge, we’ve spent the past decade partnering with the world’s top mobile gaming studios. Our DSP reaches over 2.5 billion users across premium supply sources — making us the leading gaming app retargeting platform on Android (second only to Meta and Google).

This guide shares Remerge’s proven best practices for successful in-app retargeting campaigns, including the key KPIs our top clients target and why programmatic is their secret weapon for scaling faster and smarter.

Mobile gaming categories

The mobile gaming industry comprises a range of sub-categories, including casino, puzzle, casual, role-playing, action, strategy, and sports.

Titles across these sub-categories typically rely on a freemium business model, where users download the app and access basic functionalities at no cost but must make in-app purchases to unlock the full game experience.

Gaming studios are among the heaviest adopters of in-app retargeting to generate revenue. User growth in the mobile gaming industry isn’t slowing down, meaning marketers can advertise to large global audiences of newly acquired players to convert them into paying customers and encourage previous purchases to buy again.

Remerge helped Matchington Mansion increase its return on ad spend (ROAS) by segmenting and retargeting gamers based on their in-app inactivity and previous purchase amounts. The campaigns led to more in-app purchases across the US and Europe and a +12% ROAS target increase.

Remerge enabled Nexon to better its gaming app ROAS targets for iOS and Android by retargeting gamers for its Maplestory M title based on 7 days of inactivity and previous purchases. This resulted in a +138 % ROAS target achievement on Android and +51% for iOS.

Triwin Games worked with Remerge to retarget Android users in North America, the largest market for its Tycoon Casino title. The campaigns focused on gamers’ previous purchase history and surpassed ROAS targets by 15%.

3 benefits of retargeting mobile gamers

In-app retargeting increases revenue by identifying and targeting gamers based on their value, keeping paying gamers engaged, and providing opportunities to upsell non-payers.

Maximize revenue from high-value users, aka whales

Every unretargeted player is a missed revenue opportunity. Marketers must not let whales swim away — a precise and well-planned app retargeting campaign will turn casual gamers into loyal spenders and maximize every marketing dollar.

Most mobile games rely on a small segment of paying users to generate a sizeable chunk of their revenue. Whales typically account for over half of a game’s income, so reeling these users in and holding their attention is critical to sustained growth. Whale benchmarks vary by sub-category and game type, but users with only one purchase deliver low return on ad spend (ROAS). Whales are generally users who make 4-5 purchases (or even up to 10 in some games).

Identifying and segmenting top payers according to their life-time value (LTV) results in significantly higher ROAS and makes these users ideal candidates for more aggressive bidding strategies. This approach can be more accurate than purchase counting (for example: one user makes 5 purchases worth 1$ each, another user makes just 4 purchases, worth 50$ - the second user is more likely to drive high ROAS than the first one).

Drive user retention and re-engagement

On average, mobile games experience a 90% churn rate. Every year, the number of new titles entering the market increases, so having a great game is no longer enough. Marketers must reduce post-install drop-offs by getting their content in front of gamers at the right time.

Week 1 is the most crucial for mobile games. The first purchase usually happens around Day 2, accounting for 25% of all buyers, and gradually declines after that point. 86% of Remerge’s gaming clients set inactivity windows to less than 7 days, with many setting their inactivity window at 0 days. These marketers also invest in micro-segments, such as paying users before day 7. This strategy allows them to win and retain users before they install and engage with another game. Competition is intense - similar apps know the value of their competitors’ audience and will bid aggressively if their rivals fail to retarget users sooner.

Convert non-payers into payers

Less than 2% of mobile gamers make an in-app purchase, and of those who do, only 29% are likely to spend again. With a large portion of non-payers unlikely to convert, many gaming apps focus their retargeting efforts on previous payers. Others, however, experiment with non-payers as an upsell opportunity and analyze their user base to find gamers with the highest chance of conversion. Finding common attributes of users who convert into first purchasers (for example, in certain games, users tend to convert to first purchasers after reaching a certain level within the game) is key to generating revenue from this segment. For these campaigns, Remerge recommends excluding long-lapsed and disengaged users.

Remerge’s best practices for retargeting mobile gamers

Below are the core elements of running a retargeting campaign for a mobile game. These are based on Remerge's learning from more than 10 years of working with top gaming studios.

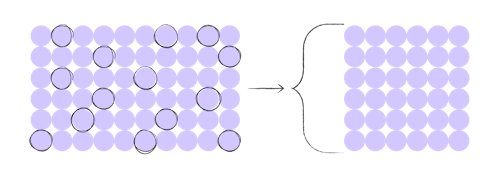

Segmentation and targeting

Remerge builds and optimizes bidding strategies for mobile gaming retargeting campaigns based on predicted user value, using factors like previous purchase history to guide spending.

Here’s a snapshot of a segmentation and targeting strategy for mobile games:

- Number and recency of previous purchases: The majority of Remerge clients target payers (PP) over players (FTP). For example, users who complete a transaction immediately see an ad with a special offer for future purchases.

- Aggregated spend level: Remerge campaigns involve splitting payers based on their LTV: low, mid, high (whales).

- Recency of last activity: 86% of Remerge’s gaming clients set their inactivity window to less than 7 days. Their campaigns target non-payers immediately after the install, as most users convert as soon as they install the app (for example, these clients retarget users who have recently installed the app with a personalized “new sign-up” offer).

KPIs, metrics, and user attributes

- Return on Ad Spend (ROAS): ROAS is the most commonly used KPI for gaming apps that monetize via in-app purchases. It shows the campaign’s effectiveness in generating revenue relative to ad spend. In essence, a high ROAS means better returns for the campaign. Most of Remerge’s gaming clients focus on Day 7 and Day 30 cohorts.

- Cost-per-action (CPA): Gaming apps also focus on specific CPAs for their campaigns, such as the cost per returning user or cost-per-in-app purchase. Remerge bidding algorithms are optimized on CPA metrics, ensuring campaigns achieve the lowest possible cost per acquisition while maintaining efficiency in ad spend.

- Re-engagement rate: The re-engagement rate measures the percentage of users who return to the app after being targeted with a retargeting campaign.The re-engagement rate lets marketers measure the effectiveness of a campaign in winning back lapsed users, improving overall user retention, and boosting lifetime value.

- Retention rate: The retention rate measures the percentage of users who return to an app during a defined period after the install and is an effective metric for gaming apps that focus on long-term user engagement.

- Lifetime value (LTV): User Lifetime Value (LTV) is the total revenue generated in the app by a specific user. It is the best predictor of future ROAS performance. Remerge uses LTV to optimize campaign spending toward the best-performing users based on their customer revenue data.

Creatives

Remerge gaming retargeting campaigns incorporate all available ad formats (static, native, video, HTML, rich media, dynamic ads) to increase the number of bidding opportunities for each user. This allows Remerge to improve how it bids on the auction price, which helps increase campaign performance. A/B testing different ad formats in real-time allows the team to identify top-performing ads and adjust spend for better results.

Check out Make It Worth The Click for a detailed breakdown of how to design the perfect retargeting ad, including proven copy and messaging, and visual elements.

Optimization

Deep links direct a user to a specific page or location within an app. By simplifying the user journey from the ad click to the delivery of content, marketers will increase the likelihood of conversions. This is especially crucial for mobile games advertising, where user attention spans are short and new titles can catch their eye. One of Remerge’s clients began using Universal Links (the Apple-specific deep link) with their retargeting campaigns and immediately saew the campaign re-engagement rate increase by 500%.

At Remerge, we found that one of our clients saw a 250% increase in re-engagement rates once we implemented Apple Universal Links into their iOS retargeting campaigns.

Why Remerge’s gaming clients run app retargeting campaigns

“Driving in-app purchases from lapsed users” is the most common reason gaming studios run retargeting campaigns with Remerge.

KPIs Remerge gaming clients favor

Approximately 43% of Remerge gaming clients use Return on Ad Spend (ROAS) as their primary KPI.

Cost-per-action is the second most commonly used KPI at Remerge, with 22% of Remerge’s gaming clients using this as their primary KPI. 7 days or less is the most commonly used inactivity window among Remerge gaming clients, meaning they typically favor early retention strategies.

Where to spend retargeting budgets for mobile games

Whether it’s unveiling a mobile game to a mass audience or breaking into new territories with an existing title, marketers must contend with an array of factors when deciding which countries to invest in, including different cultures, languages, consumer behaviors, and technology standards.

Establishing any app and re-engaging users in a new market is difficult, but with the right approach from the beginning, the long-term impact on user and revenue growth can be huge.

Marketers have three main tiers to consider. These categorize countries based onconsumer behavior and purchasing habits, helping marketers decide which locations to prioritize.

Tier 1

Tier 1 is typically the most expensive and competitive market. Tier 1 is among the biggest markets for user volume and includes some of the most mature mobile audiences, with high smartphone adoption and in-app spending. This market sees some of the highest cost-per-install (CPIs) and cost-per-mille (CPMs) numbers in the world, especially within North America. For mobile gaming, marketers investing in tier 1 must compete with more apps than any other tier, intensifying the need for unique offers and stand-out creatives.

Tier 2

Tier 2 is a sizable but smaller, less competitive market when compared to tier 1, and consumer spending is usually lower. Programmatic traffic within tier 2 is considered more affordable as well, but prices vary and can be unpredictable. This is a diverse market in terms of language and culture, meaning the demand for localized content is high.

Tier 3

Tier 3 is a large market that includes developing countries. It is the least competitive market and is considered to have the lowest consumer purchasing power. Smartphone adoption rates in tier 3 are growing, but maturity has not reached the levels of tier 1 and tier 2 markets. Programmatic traffic within tier 3 tends to be cheap, with significantly lower CPIs and CPMs compared to tiers 1 and 2. English is not the primary language within this market, meaning it requires considerable time and effort to localize content.

Download our Games Gone Global guide for strategies for growing your gaming app internationally, including tips from Rec Room and Rovio mobile gaming pros.

Remerge’s DSP for retargeting campaigns instead of Google and Meta

Remerge’s demand-side platform (DSP) offers higher scale, increased efficiency, and unbiased results compared to Google and Meta.

Increased scale

Advertisers won’t find all their users on Google and Meta alone. They increas their scale by running programmatic retargeting ads, therefore, increasing the chance of finding their users while they’re on other apps throughout the day. Remerge reaches more than 2.5B users across the open internet through our premium supply channels.

Greater efficiency

There are more traditional marketers advertising on Google and Meta, which drives up costs. Through Remerge's industry-leading scale and intelligent bidding engine, we enable marketers to find high-value users at optimal price points.

Unbiased results

Google and Meta are walled gardens, meaning they control both sides of the advertising ecosystem. They provide their own attribution numbers, so their performance is not verified by a third party. Remerge works with mobile measurement providers (MMPs) to measure performance and validate results.

Get started with Remerge